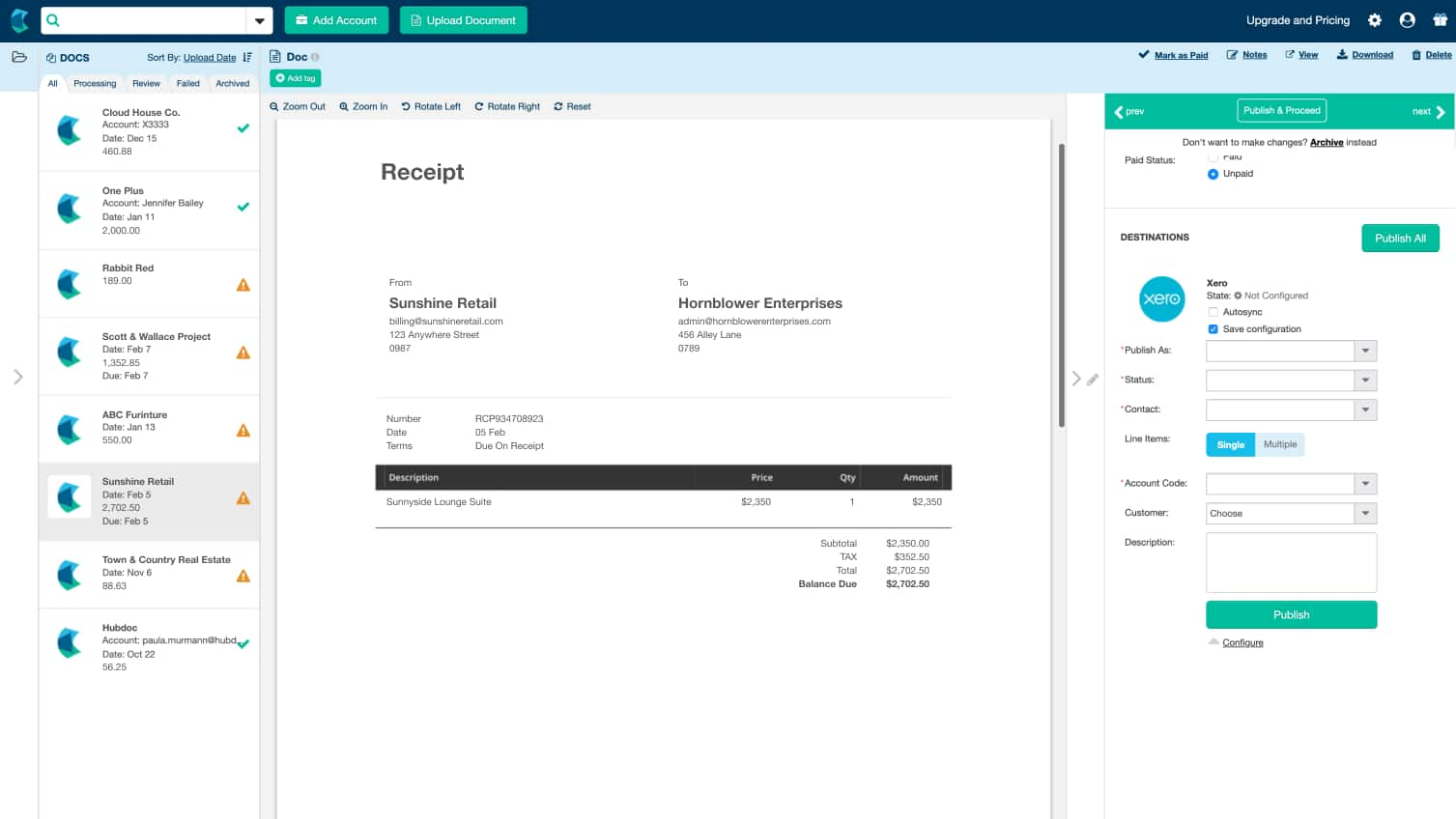

* We use Dext/Hubdoc packages to process unlimited supplier invoices and receipts per month.

** The above prices include the Xero monthly subscriptions (in some cases these are billed separately, only for payment purposes).

CONTACT US for a quote on a package that is tailor-made to suit your business.